Risk: What it Function inside Using, Ideas on how to Level and you can Do It

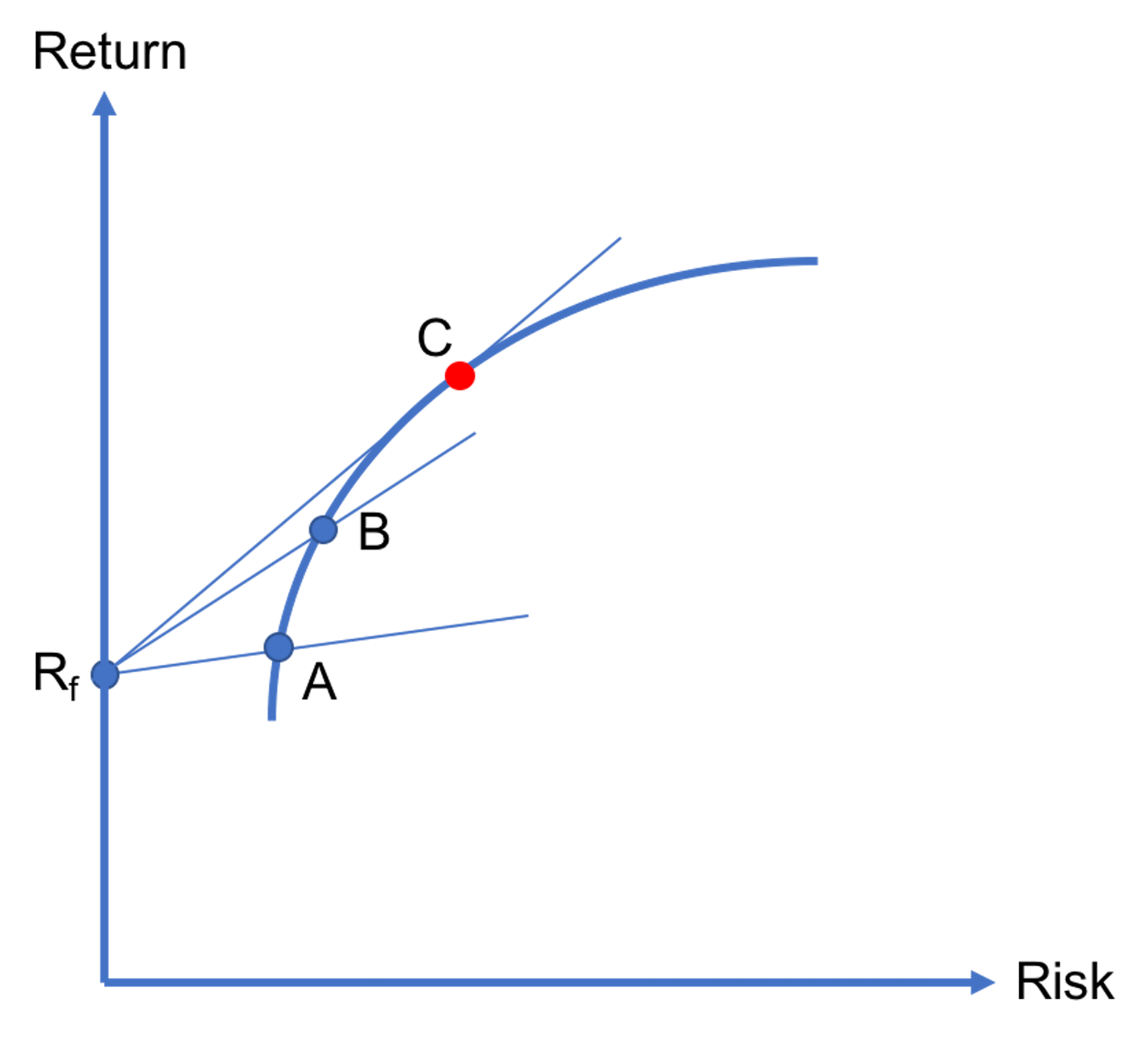

However, theoretic habits advise that the type of innovation is essential to help you knowing the state-of-the-art dating ranging from R&D, risk and you will go back 10–14. These procedures will help buyers identify issues that could change the investment’s value and you can estimate the possibility downside. The relationship between chance and you can get back try a good foundational idea inside the monetary concept. There is certainly an optimistic correlation anywhere between these variables, the general code getting “the greater amount of the level of chance, the higher the possibility come back (or losses respectively). To attain an optimal chance and you will come back result, people explore various other ways to get acquainted with risk and you will assess chance-adjusted production as a result of metrics such as the Sharpe proportion and Sortino proportion. A security financing you will give high production but has improved industry volatility.

Tips in order to Assess the risk-100 percent free Rates inside the Do well: aave price prediction 2025

Expense things for example carries, choices, bonds, and you will types carry counterparty chance. Governmental risk ‘s the chance you to a financial investment’s productivity you will experience due to political instability or changes in a country. These types of chance is stem from a change in government, legislative regulators, almost every other foreign plan suppliers, or military manage. Called geopolitical exposure, the danger grows more out of a factor as the a financial investment’s date horizon gets prolonged.

With GICs and you will dumps you additionally have the excess protection from put insurance rates on the amounts to $one hundred,one hundred thousand should your financial institution goes bankrupt. Although not, he’s a reduced potential get back than riskier investments and will most likely not keep up that have rising cost of living. Fundamentally, regulators bonds try regarded as as the lowest risk, with investment-stages business bonds. A higher standard departure suggests greater risk and potential for better deviation in the expected come back.

Simple tips to Estimate Profile Exposure and you may Go back in the Excel

Variance is especially helpful in collection concept because the difference away from a portfolio isn’t simply the average from personal investment variances—in addition, it hinges on just how assets flow prior to each other (correlation). That it mathematical assets makes variance essential for enhancing portfolio risk. The new carrying period return is one of the most simple implies determine financing overall performance. It exercise the entire return gained across the whole several months you stored an investment, along with one another money development and people money acquired (such returns otherwise interest). An adequately ideal portfolio recommendation depends on newest and you will exact financial and you may risk pages.

The best—and energetic—strategy for reducing exposure are variation. A properly-varied profile tend to incorporate different types of ties from varied markets that have different amounts of risk and you aave price prediction 2025 will relationship with every other’s production. Such as, if Money A posses the average get back out of 8% having an elementary deviation from 2%, while you are Investment B also has the average come back out of 8% but with a basic deviation away from ten%, Money B is much riskier.

Whenever a brokerage lets you know the possibility of confirmed financing, they’lso are declaring which on the best of the elite wisdom. On their own of a specialist’s assessment, you will want to note that safe opportunities is generate losses, high-risk assets is tidy up. So it’s important to plan out disregard the meticulously to protect your own currency. You’re going to get particular economic estimates from prospective experience affects, letting you understand the real cost of seller-related disturbances, and then make informed behavior on the event response investment.

Using the concepts of the concept, assets are joint within the a collection centered on mathematical proportions for example while the fundamental departure and you may correlation. The risk/go back proportion helps traders determine whether or not a possible financing will probably be worth and make. A lower ratio implies that the possibility award is actually higher than the potential exposure, while you are a leading proportion setting the alternative. From the understanding the exposure/come back ratio, buyers tends to make much more advised decisions about their opportunities and perform its risk better.

“Sure wagers” compared to. riskier alternatives—organization management create prefer a great “sure choice”:

By dispersed opportunities across the other investment classes, sectors, and you will geographical nations, people can lessen the fresh feeling from private funding losses on the total collection. Diversity works on the principle that not all of the investment does the same way at the same time. Whenever you to investment does improperly, various other may be doing well, assisting to mitigate full profile chance. Systematic dangers, also known as business threats, are dangers that can apply to a complete financial field total or lots of the entire market. Market chance ‘s the risk of shedding investment due to points, for example political risk and you can macroeconomic chance, affecting the new results of your own overall market.

Real-Go out Round-Ups investment accrue instantly to possess money inside second exchange screen. We really do not create customer financing or hold child custody from property, we let profiles affect associated monetary advisors. In order to determine beta, separate the new variance (which is the way of measuring the way the field motions relative to their imply) because of the co-difference (the measure of a stock’s get back prior to regarding the marketplace). Whenever retirees begin withdrawing later years fund throughout the symptoms from industry downturns, the value of its portfolios decrease rapidly, leaving shorter financing open to recover when the segments begin boosting. To own large-net-well worth (HNW) investors, that it threatens not simply its monetary security plus their ability to leave a lasting legacy.

Just how do Black colored Swan Incidents Relate with Chance Government, and just how Is Buyers Get ready for Her or him?

Whenever committing to overseas places, it’s vital that you think about the undeniable fact that foreign exchange cost is also replace the cost of the brand new advantage also. Currency exchange chance (otherwise exchange rate chance) pertains to all monetary devices that are inside the a currency most other than simply your own residential money. Particular risks, for example borrowing risk, may determine all round chance profile out of a financial investment. Simultaneously, unsystematic exposure, that’s unique in order to private assets, will likely be quicker thanks to variation. The brand new coefficient from version (CV) are determined by the isolating basic deviation by indicate get back.

Purchase, a single money membership and therefore spends inside a collection of ETFs (exchange replaced finance) demanded to help you customers according to the investment objectives, time vista, and risk threshold. Bitcoin exposure exists from the ETF BITO, and this invests inside Bitcoin futures. This really is thought a premier-exposure financing considering the speculative and you can unstable characteristics. Assets inside Bitcoin ETFs may not be suitable for the buyers and should just be employed by those who know and you will deal with those threats. Traders looking to direct exposure to the price of bitcoin must look into a new funding. The fresh ETFs comprising the new profiles charges charge and you will costs that can remove an individual’s get back.

There are many different kind of exposure you to definitely traders need consider when designing funding behavior. These types of dangers is going to be broadly categorized to the systematic risk and unsystematic risk. Scientific exposure, known as industry exposure, means risks that affect the entire market and should not getting diversified away. Issues including economic conditions, interest levels, and you may geopolitical situations can be all the subscribe to scientific risk. Unsystematic chance, at the same time, is specific so you can private bonds otherwise marketplace and certainly will be shorter because of variation.

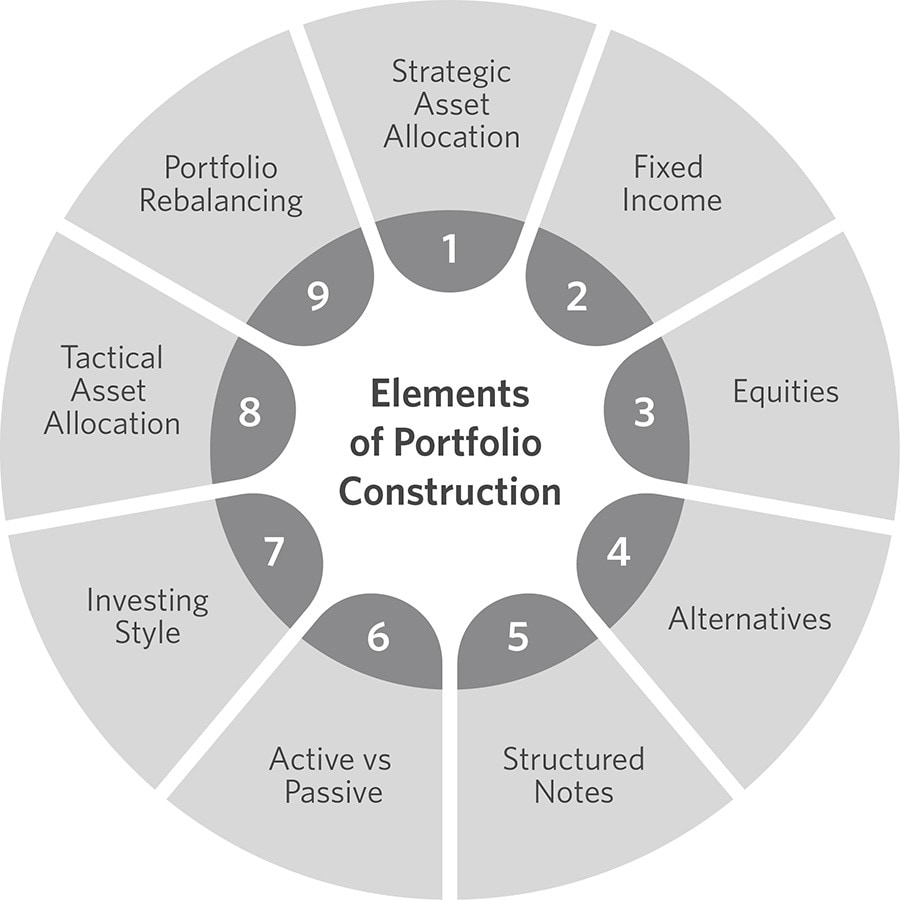

Different types of risks is enterprise-particular exposure, industry-certain chance, competitive risk, international risk, and you will market risk. Also, expertise and you may monitoring items such interest rate chance, exchangeability chance, and field volatility may help buyers make told behavior. Regularly looking at and you can adjusting the fresh funding profile based on market conditions and private financial items is also then enhance efficiency and you will do risks. Understanding the exchange-from ranging from risk and you can come back is vital to have energetic collection administration.