Comprehensive Guide to Forex Trading Education 1932402219

Comprehensive Guide to Forex Trading Education

The world of Forex trading is both alluring and complex. As a decentralized marketplace for trading global currencies, the Forex market is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. For those looking to navigate this vast landscape, acquiring the right education is crucial. The purpose of this article is to provide a comprehensive overview of Forex trading education, guiding you through essential concepts, practical strategies, and available resources such as forex trading education exglobal.pk to help you embark on your trading journey.

Understanding the Forex Market

Before diving into Forex trading, it’s essential to grasp how the market operates. Unlike stock trading, Forex operates 24 hours a day, five days a week, and involves currency pairs. When you trade one currency for another, you’ll notice pairs such as EUR/USD or GBP/JPY. The first currency is the base currency, and the second is the quote currency. This pairing indicates how much of the quote currency is needed to purchase one unit of the base currency.

The Importance of Education in Forex Trading

Education plays a critical role in successful Forex trading. Unlike traditional investments, Forex trading involves high risk, given the market’s volatility and leverage options. Proper education helps traders develop the necessary skills and knowledge to make informed decisions, manage risks, and adopt effective trading strategies. Here are some key aspects of Forex education:

1. Key Concepts and Terminology

Understanding Forex-specific terminology is crucial. Terms such as pips, spreads, leverage, and margin must be familiar to any trader. A pip refers to the smallest price move that a given exchange rate can make based on market convention, while spreads represent the difference between the buy and sell price of a currency pair. Leverage allows traders to control larger positions with a smaller amount of capital, which can amplify both potential gains and losses.

2. Fundamental Analysis

Fundamental analysis involves analyzing economic indicators and events that can influence currency values. Central bank policies, interest rates, inflation, and geopolitical events can cause significant fluctuations in the Forex market. Thus, traders need to stay updated on global economic news and understand how these factors impact currency trading.

3. Technical Analysis

Technical analysis focuses on price movements and trading volumes to predict future market behavior. Utilizing charts and indicators like moving averages, RSI (Relative Strength Index), and Fibonacci retracement levels, traders can identify trends and make informed trading decisions based on historical price patterns.

4. Risk Management

Even the most successful traders will experience losses. Consequently, effective risk management is essential to long-term success. Education should include lessons on setting stop-loss orders, determining position sizes, and diversifying investments to manage exposure to risk.

Developing Your Trading Plan

A well-structured trading plan is a cornerstone of Forex trading success. Your trading plan should outline your trading strategies, goals, and the metrics you’ll use to measure your success. Here are fundamental components to consider when developing your plan:

1. Define Your Trading Goals

Determine your objectives as a trader. Are you looking to trade part-time, or do you aim to become a full-time trader? Establishing clear goals will help you stay focused and measure your progress.

2. Choose a Trading Style

There are several trading styles, including day trading, swing trading, and scalping. Each has different time commitments and risk profiles. Decide on the style that aligns with your goals, personality, and availability.

3. Develop Entry and Exit Strategies

Creating a clear set of criteria for entering and exiting trades is vital. This aspect of your plan should align with your technical and fundamental analysis findings, and you should consistently apply it to all trades.

Resources for Forex Trading Education

Numerous resources are available for those looking to enhance their Forex trading knowledge:

1. Online Courses and Webinars

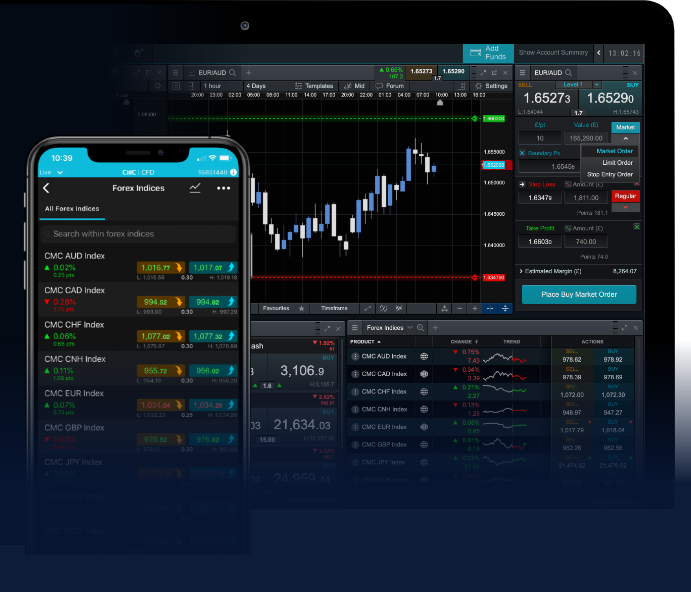

Many platforms offer structured online courses, video tutorials, and live webinars by experienced traders. These resources can help streamline your learning process and provide insights that may not be readily available in books.

2. Forex Blogs and Forums

Engaging with the Forex community can be incredibly beneficial. Forex blogs and forums allow you to learn from experienced traders, share insights, and discuss various strategies and market trends.

3. Trading Simulators

Most brokerage platforms offer demo accounts that allow you to practice trading in real market conditions without risking actual capital. This hands-on experience can be invaluable in building your confidence and refining your skills.

Staying Updated with Market Trends

The Forex market is continually evolving, influenced by global economic changes, policy announcements, and geopolitical events. Staying updated with market trends and developments is crucial. Follow economic calendars, market news sources, and subscribe to analytical platforms to gain insights into the factors driving market sentiment.

Conclusion

Forex trading can be a rewarding venture, but it requires a solid educational foundation, strategic thinking, and a disciplined approach. By investing time in your Forex education, understanding key concepts, and utilizing available resources, you can enhance your trading skills and increase your chances of success in this exciting market. Remember, consistency and continuous learning are vital to developing a sustainable Forex trading career. Engage with reputable resources and communities, practice diligently, and keep refining your strategies to meet your trading goals.